Welcome to The Ultimate Guide to Achieving a Rich Lifestyle! Are you ready to unlock the secrets to living a life of abundance and fulfillment? In this comprehensive guide, we will delve into mindset shifts, setting financial goals, investing in yourself, building multiple streams of income, overcoming limiting beliefs, creating a budget that works for you, and embracing minimalism. Get ready to transform your mindset and take actionable steps towards creating the rich lifestyle you deserve!

Mindset Shifts: How to Think and Act Like the Wealthy

To achieve a rich lifestyle, it all starts with your mindset. The wealthy think differently – they see opportunities where others see obstacles. Shift your focus from scarcity to abundance. Embrace a positive outlook on wealth and success.

Acting like the wealthy means taking calculated risks and stepping out of your comfort zone. Be willing to invest in yourself and your future without fear of failure. Surround yourself with successful individuals who inspire and motivate you to strive for greatness.

Develop a growth mindset that embraces challenges as opportunities for growth. Learn from setbacks and use them as stepping stones towards achieving your goals. Remember, wealth is not just about money; it’s also about personal development and fulfillment.

By adopting the mindset of the wealthy, you can attract prosperity into your life and create the abundance you desire. Start thinking and acting like the wealthy today to set yourself on the path towards financial success!

Setting Financial Goals

Setting financial goals is an essential step towards achieving a rich lifestyle. It’s like plotting a roadmap to your dream destination. Start by envisioning where you want to be financially in the short and long term. Whether it’s buying a house, traveling the world, or retiring comfortably, clarity is key.

Make your goals specific, measurable, achievable, relevant, and time-bound – SMART goals are your best friend here. By setting clear objectives like saving a specific amount each month or paying off debt by a certain date, you give yourself direction and motivation.

Track your progress regularly to stay on target. Celebrate small wins along the way to keep yourself motivated and focused on the bigger picture. Remember that financial goals can evolve as your circumstances change; flexibility is key to adapt and grow.

Stay committed to your goals even when challenges arise – because they will! With determination and perseverance, you’ll be well on your way to realizing your financial dreams.

Investing in Yourself: Education, Health, and Experiences

Investing in yourself is one of the most valuable things you can do to achieve a rich lifestyle. Education plays a crucial role in personal development and career advancement. Whether it’s taking courses, reading books, or attending workshops, continuous learning opens up new opportunities.

Prioritizing your health is essential for long-term success and happiness. Regular exercise, nutritious food choices, and mental well-being practices contribute to overall wellness. Remember that a healthy body and mind are key assets in reaching your goals.

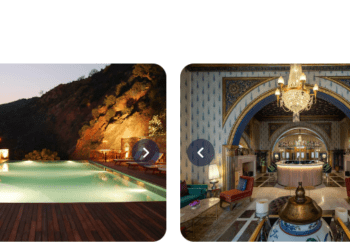

Experiences enrich your life by providing valuable lessons and unforgettable memories. Traveling to new places, trying different activities, and stepping out of your comfort zone are all ways to invest in meaningful experiences that shape who you are becoming.

Investing in yourself sets the foundation for growth and fulfillment on your journey towards a rich lifestyle.

Building Multiple Streams of Income

Are you tired of relying on a single source of income to achieve your financial goals? Building multiple streams of income is key to creating a rich lifestyle. Diversifying your revenue sources not only increases your earning potential but also provides security and flexibility.

One way to start is by exploring different passive income opportunities such as investing in stocks, real estate, or building an online business. These ventures can generate money while you sleep, allowing you to earn without trading time for dollars.

Another option is to leverage your skills and expertise by offering freelance services or consulting work. By monetizing what you’re passionate about, you can turn hobbies into profitable side hustles.

Don’t limit yourself – consider branching out into various industries and sectors to maximize your earning potential. Remember, the more diverse your income streams, the more resilient you’ll be against economic fluctuations.

Navigating Money Mindsets and Overcoming Limiting Beliefs

When it comes to navigating money mindsets and overcoming limiting beliefs, it’s crucial to understand the power our thoughts hold over our financial success. Our beliefs about money shape our actions and ultimately impact our wealth accumulation.

Many of us carry deep-seated beliefs inherited from childhood or societal conditioning that may limit our financial growth. It’s essential to identify these limiting beliefs and replace them with empowering ones that align with abundance and prosperity.

One effective way to shift your money mindset is through self-reflection and awareness. By challenging negative thoughts about money, you can start reprogramming your subconscious mind for success.

Surrounding yourself with positive influences, whether through books, podcasts, or mentors, can also help reshape your perspective on wealth creation. Remember, changing your mindset is a continuous journey that requires dedication and perseverance.

Creating a Budget and Sticking to It

Creating a budget is essential for achieving financial success. It allows you to track your expenses, prioritize your spending, and save for the future. Start by listing all your sources of income and monthly expenses. Be realistic about your numbers and leave room for unexpected costs.

Once you have a clear picture of your finances, set specific financial goals that align with your values. Whether it’s saving for a vacation or building an emergency fund, having concrete objectives will help you stay motivated.

To stick to your budget, consider using tools like budgeting apps or spreadsheets to monitor your progress regularly. Find areas where you can cut back on expenses without sacrificing quality of life.

Remember that creating a budget doesn’t mean depriving yourself; it means being intentional with how you allocate your money. Stay disciplined and adjust as needed to ensure long-term financial stability.

Embracing Minimalism and Reducing Materialistic Desires

In a world where consumerism often dictates our choices and desires, embracing minimalism can be a powerful tool in achieving a rich lifestyle. By focusing on what truly matters and reducing materialistic tendencies, we free ourselves from the burden of excess possessions and find contentment in simplicity.

Minimalism is not about deprivation but rather about intentional living. It allows us to prioritize experiences over things, relationships over possessions, and personal growth over superficial wealth. By decluttering our physical space as well as our minds, we create room for more meaningful pursuits and connections.

When we let go of the need to constantly acquire more stuff, we open ourselves up to greater abundance in other areas of life. We become less focused on keeping up with external expectations and more attuned to our own values and aspirations. This shift in mindset paves the way for true wealth – not just in terms of money but also in fulfillment, purpose, and happiness.

So as you embark on your journey towards a rich lifestyle, remember that true richness lies not in how much you have but in how deeply you appreciate what you already possess. Embrace minimalism, reduce your materialistic desires, and watch as your life becomes richer in ways you never imagined possible.